Individual and business solutions made simple

The Advanced Markets team at Midland National is here to help with your business and high-net-worth individual life insurance cases.

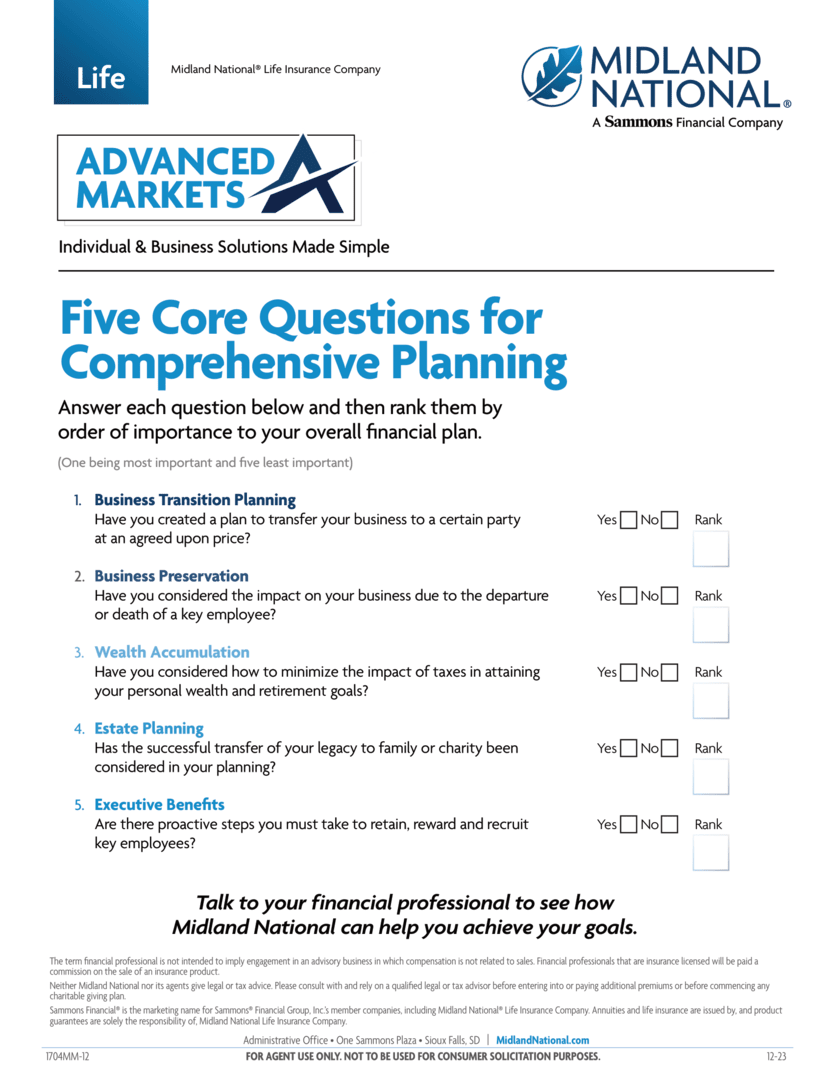

Five Core Needs

Midland National offers comprehensive solutions for a variety of needs. To help review a client’s needs and prioritize areas of concern, download the Five Core Needs worksheet to walk through each area.

Download flyerSales Concepts

View marketing brochures, materials, forms, and more for each type of case design.

Business Transition Planning

Business Preservation

Wealth Accumulation

- Supplemental Income

- Tax Planning

Estate Planning

- Irrevocable Life Insurance Trust (ILIT)

- Spousal Lifetime Access Trust (SLAT)

- Estate Equalization

- Family Limited Partnership/Liability Company

- Credit Shelter Trust

- Qualified Personal Residence Trust

- Crummey Power

- Revocable Living Trust

- Grantor Retained Annuity Trust

- Beneficiary Defective Inheritor's Trust

- Charitable Planning

Resources

Want to expand your reach and tap into new audiences? Share engaging content through social media, email, in-person meetings and more.

View additional resources available to you through Midland National.

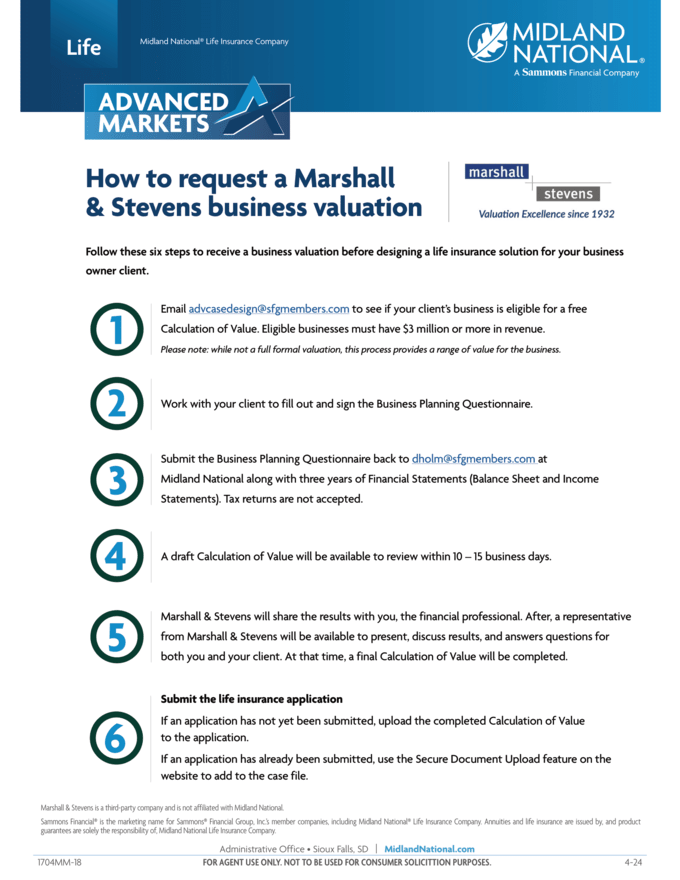

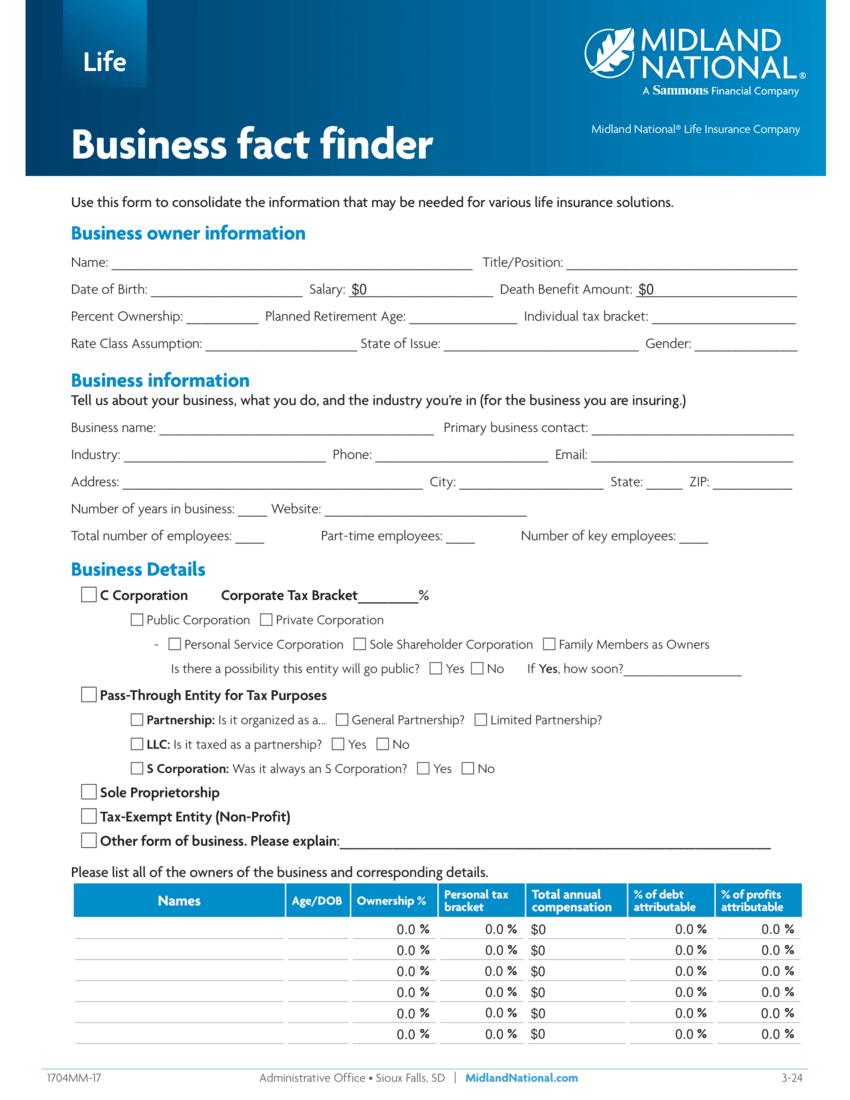

Marshall and Stevens Resources and Buy-Sell Review

Businesses eligible for a complimentary calculation of value must have $3 million or more in annual revenue.

Other Resources

Meet Our Team

With over 70 years of combined industry experience, the Midland National Advanced Markets team offers a unique combination of expertise and the ability to simplify even the most complex life insurance concepts. Andrew, Tom and Dianna work hand-in-hand with our regional teams to provide expertise and collaboration on complex cases. Have a question for the team? Send them a note at advcasedesign@sfgmembers.com.

Andrew Rinn

JD, CFP®, CLU, ChFC,

AVP, Advanced Markets

Dianna Holm

CLU

Advanced Markets

Case Design Consultant

Polina Engel

JD, CLU

Director, Advanced Markets Life

Matt Erpelding

CLU, ChFC

Advanced Markets Case Design Consultant

Webinar recordings

Browse recordings of past webinars to catch up on valuable information you may have missed the first time around.

Join us for an insightful session on Executive Retention+, a flexible, employer-controlled life insurance concept available through Midland National. This innovative, four-tiered strategy can help business owners: • Protect their business • Reward and retain top talent • Support long-term succession goals. Whether your clients need one solution or several, Executive Retention+ offers the customization they want to move forward with confidence.

Don't miss our upcoming webinar featuring Marshall & Stevens, specialists in business valuations! In this session, you'll learn what a business valuation consists of, how they are calculated and can help streamline the financial underwriting process. Plus, see how they can be leveraged for business and estate planning as an overall value-add for you and your clients.

Join us for an insightful webinar where we'll explore the potential effects of the recent election on the business landscape. Elections often bring policy shifts that influence taxation, regulation, trade, and labor markets --key factors that can directly affect how businesses operate and grow. Gain valuable insights, stay informed and be ready to navigate the potential changes an election might bring.

Join us for an exclusive webinar co-presented by Marshall & Stevens. Learn how business valuations can be a catalyst to drive activity and serve as an indispensable tool in financial underwriting.

Do you have business-owner clients looking to retain and reward employees? Join Andrew Rinn, AVP Advanced Markets, and Tom Martin, Sr Life Product & Competition Analyst, as they look at: How split dollar sales concept works; Give an overview of Loan Split Dollar arrangements; and Case studies and examples.

This insightful webinar explores the landmark case of U.S. vs. Connelly and its profound implications for estate valuation and buy-sell agreements, with expert insights from Marshall & Stevens. This session is designed to help financial professionals learn about how to accurately value their clients' estates in a buy-sell agreement.

Additional Resources

Advanced Underwriting Consultants is available to answer questions on tax and estate planning scenarios and provide sample documents for no cost to you—it's all part of your valuable Midland National contract. Reach out to Advanced Underwriting using the below contact information.

Phone: 888-899-9190

Email: MidlandNational@AdvancedUnderwriting.com

Website: AdvancedUnderwriting.com

Thought Leadership

Discover expert insights and innovative perspectives with Andrew Rinn and the Advanced Markets team through our articles and blog posts.

Bridging Silos for Client Success

Andrew Rinn and Chris Regione share their insights on how a collaborative approach elevates support for financial professionals and high-net-worth client service.

Advanced Market Playbook Strategies to Boost Business

Learn how advanced markets is an indispensable partner for financial professionals seeking to elevate their practices.

Loan Split Dollar: A renaissance in the making?

Learn why today’s financial professionals would be remiss if they didn’t seize this impactful strategy and place it in their executive benefit toolkit.

Split dollar helps attract and keep high value employees

Executive retention is now at an inflection point as businesses seek to reward and recruit highly valuable employees.

Advanced Markets of Tomorrow

Evolving business models, regulation and consumer demands are transforming the financial planning landscape.

Lessons from Connelly Case on Buy-Sell Agreements

Key takeaways from the recent Supreme Court ruling to help business owners and financial professionals navigate buy-sell arrangements.

Irrevocable Life Insurance Trust (ILIT) and Spousal Lifetime Access Trust (SLAT) should be drafted only by an attorney familiar with such matters. Neither Midland National nor its agents give tax advice. Neither Midland National, nor any of its agents, employees or representatives are authorized to give tax or legal advice. Advise customers to contact their own independent qualified tax or legal advisor before commencing any charitable giving plan.

The terms and conditions of the REBA are not part of the policy issued by Midland National® Life Insurance and as such Midland National is unable to enforce directly any restrictions on the policy that are part of the REBA agreement.

AUC only provides general tax and technical information for the information of Midland National employees and producers. AUC is not providing legal or tax advice on which a prospective or current customer can rely nor should AUC materials be used for such purposes. If legal or tax advice is needed by prospective or current customers, an independent legal counsel or tax advisor should be sought. AUC materials are not for use with, or disclosure to, any Midland National prospective or current insurance customers. Midland National and its agents do not give legal or tax advice.

Under an endorsement split dollar arrangement, your client enters into an agreement with their employer. Midland National is not a party to this agreement and Midland National’s only obligation is to administer the policy it issues consistent with the policy’s terms and conditions.

Under an endorsement split dollar arrangement, the value of the life insurance afforded the employee is taxable to the employee. The employer should provide the employee with tax reporting based on requirements specified in the tax code. The parties to the endorsement split dollar arrangement should seek their own independent legal and tax advice as to whether and how to enter into an endorsement split dollar arrangement based on the employer’s and employee’s unique circumstances.

Under a split dollar agreement, classified as a welfare benefit plan, the employee must belong to a select group of management, which includes quantitative and qualitative elements. To meet the quantitative standard, plans should be limited to the top 15% of the workforce. To meet the qualitative test, a significant disparity should exist between the average compensation of the top-hat group and the average compensation of all other employees.

Under a loan split dollar agreement, the employee enters into an agreement with the employer. Midland National® Life Insurance Company is not a party to this agreement and Midland National’s only obligation is to administer the policy it issues. (consistent with the policy’s terms and conditions).

Marshall & Stevens is a third-party company and is not affiliated with Midland National.

While the primary use of life insurance is death benefit protection, your clients may also have other needs that can be met through life insurance. The sales concepts and accompanying marketing materials below may help you broaden your sales potential. As independent contractors, it is up to you to choose which of these concepts may work for your particular sales strategy and clients, and which do not. Please note that Midland National does not require you to use any of these sales concepts; they are resources that can be used at your discretion for your own individualized sales presentations.

1704MW-19

FOR AGENT USE ONLY. NOT TO BE USED FOR CONSUMER SOLICITATION PURPOSES.

5-25